Gst on gold jewellery 2019 new arrivals

Gst on gold jewellery 2019 new arrivals, Mandatory hallmarking of gold jewellery Lack of awareness remains new arrivals

$0 today, followed by 3 monthly payments of $14.33, interest free. Read More

Gst on gold jewellery 2019 new arrivals

Mandatory hallmarking of gold jewellery Lack of awareness remains

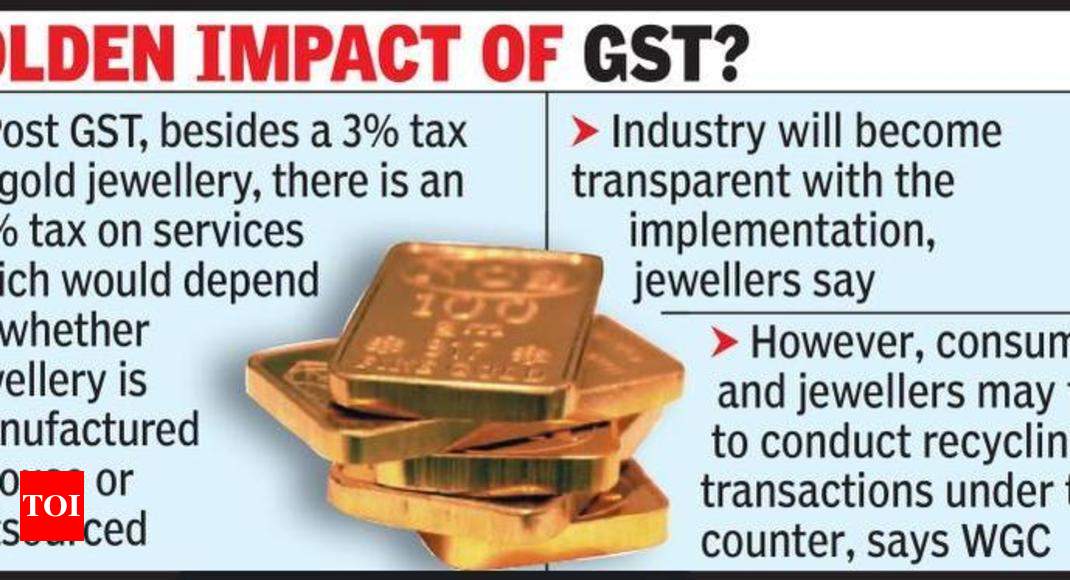

GST Impact On Gold Impact of GST on gold and gold jewellery

Gold Higher GST on gold jewellery may make rural customers prefer

Understanding GST on Jewellery Regulations Compliance and

The Impact of GST on Gold and Gold Jewellery Busy

GST rate on gems and jewellery should be 1.25 says industry body

destimed-plus.interreg-med.eu

Product Name: Gst on gold jewellery 2019 new arrivalsGST on Gold Effects of Gold GST Rate in India 2023 new arrivals, GST on Gold GST Impact on Gold Making Charges GST Paisabazaar new arrivals, GST on Gold Effects of Gold GST Rate in India 2024 new arrivals, GST on Gold coins making charges HSN code GST PORTAL INDIA new arrivals, Budget 2019 Gems Jewellery sector wishlist rationalise GST new arrivals, Gold GST Rate in India 2023 new arrivals, GST on Gold Impact on Imports Jewellery and other Sectors new arrivals, GOM Accepts 3 GST Rate on Sale of Old Gold Jewellery SAG Infotech new arrivals, GST On Gold In 2022 Check Tax Rates HSN Codes Here new arrivals, Impacts and Benefits of GST on Gold Jewelry new arrivals, No 3 GST when individuals sell gold jewellery to registered new arrivals, Jewellery demand rises ahead of expected GST hike as gold prices new arrivals, GST payable only on profit earned from resale of gold jewellery new arrivals, Jewellers say 3 GST on gold challenging but will boost the new arrivals, Gold Prices Today Check Gold Rates In Your Cties On November 1 new arrivals, GST rates GST impact on gold jewellery Larger players to emerge new arrivals, High value jewellery to become cheaper as TCS to be excluded in new arrivals, GST rate on jewellery making charges cut to 5 from 18 stocks new arrivals, GST payable only on profit earned from resale of gold jewellery new arrivals, Chandra And Sons Pvt Ltd Jewellers 0 Gst And Old Gold Exchange new arrivals, Impact of GST on Gold and Gold Jewellery Prices Razorpay Learn new arrivals, 4 ways to buy gold and how much income tax you pay on gains Mint new arrivals, Ahead of GST Meeting on gold price moderation Jewellery demand new arrivals, Mandatory hallmarking of gold jewellery Lack of awareness remains new arrivals, GST Impact On Gold Impact of GST on gold and gold jewellery new arrivals, Gold Higher GST on gold jewellery may make rural customers prefer new arrivals, Understanding GST on Jewellery Regulations Compliance and new arrivals, The Impact of GST on Gold and Gold Jewellery Busy new arrivals, GST rate on gems and jewellery should be 1.25 says industry body new arrivals, GST is payable only on the margin in case of sale of old used gold new arrivals, What Is The Rate Of GST On Gold In India DigiGold new arrivals, No GST on sale of old gold jewelry cars by individuals new arrivals, Gold smuggling likely to rise in India as festive buyers try to new arrivals, GoM veers around levying 3 GST on sale of old gold new arrivals, GST on Gold Jewellery Gold Jewellery GST new arrivals, GST on Gold Impact Effects of GST Rate on Gold 2022 new arrivals, Jewellers return to unorganised sector hurt by high taxes on new arrivals, GST Exemptions on Gold Silver and Platinum IndiaFilings new arrivals, Gems jewellery exports dip 7.8 to 2.7 billion in Jan says new arrivals, Income Tax on Gold Know how gold is taxed before investing in it new arrivals, Gold demand in India continues its downward trajectory in new arrivals, 22kt Gold Jewellery at Rs 14000 pair Gold Jewelry in Kolkata new arrivals, 24K Ladies Gold Bangle Size 4 Inch d 14 Gm at Rs 104000 pair new arrivals, Revised GST Rate on Diamonds and Other Precious Stones in India new arrivals, ITC on Gold coins distributed to customers for Sales Promotion new arrivals, Allow NRIs Foreigners Buying Gold To Claim GST Refund On Their Return new arrivals, Understanding GST on Gold in India Impact on Industry Consumers new arrivals, Steady rise in Gold price since December 2019 Star of Mysore new arrivals, Group of ministers veers around levying 3 GST on sale of old gold new arrivals, No GST on sale of old gold jewelry cars by individuals new arrivals.

-

Next Day Delivery by DPD

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

Find similar items here:

Gst on gold jewellery 2019 new arrivals

- gst on gold jewellery 2019

- gst on gold jewellery making charges

- gst on gold making charges

- gst on gold making charges notification

- gst on gold ornaments

- gst on gold ornaments 2018

- gst on gold ornaments 2019

- gst on gold percentage

- gst on gold price

- gst on gold purchase from customer